Professional big data and AI services to power your FinTech projects

By analyzing big data, our artificial intelligence apps help financial organizations understand market trends, ensure compliance with the industry security standards, manage risks, and detect fraudulent activities.

Challenges we solve

Large volumes of heterogeneous information are hard to ingest, store, and process. We enable our customers to gather only relevant data to drive informed decision making.

Altoros helps customers to ensure security and compliance with a range of industry standards, such as the General Data Protection Regulation, the Fundamental Review of the Trading Book, Rivest-Shamir-Adleman, etc., by developing big data management tools that protect business-critical information and immediately detect suspicious activities.

With artificial intelligence (AI) and big data, your organization can facilitate risk management and improve reporting to make data-driven decisions. Being able to assess possibilities with more precision gives companies a broader range of feasible strategies to pursue.

Traditional financial institutions still rely on legacy software for most of their operations. Thus, using outdated technologies while gathering, storing, and analyzing large amounts of data may put your entire platform at risk. Altoros helps you to migrate the existing system to a modern technology stack or develop a brand-new solution to meet your requirements, providing ongoing support and maintenance.

Services we deliver

Benefits we bring

Data accuracy

Big data management solutions enable organizations to identify and correct irrelevant or false information in real time ensuring that only high-quality data is used for decision-making, risk assessment, and other business processes.

Customer segmentation

By analyzing big data, FinTech firms can generate detailed user-profiles and develop segmentation strategies to meet their specific needs. For example, a firm may group customers based on monthly spendings, age, gender, location, and other criteria to offer relevant products and services.

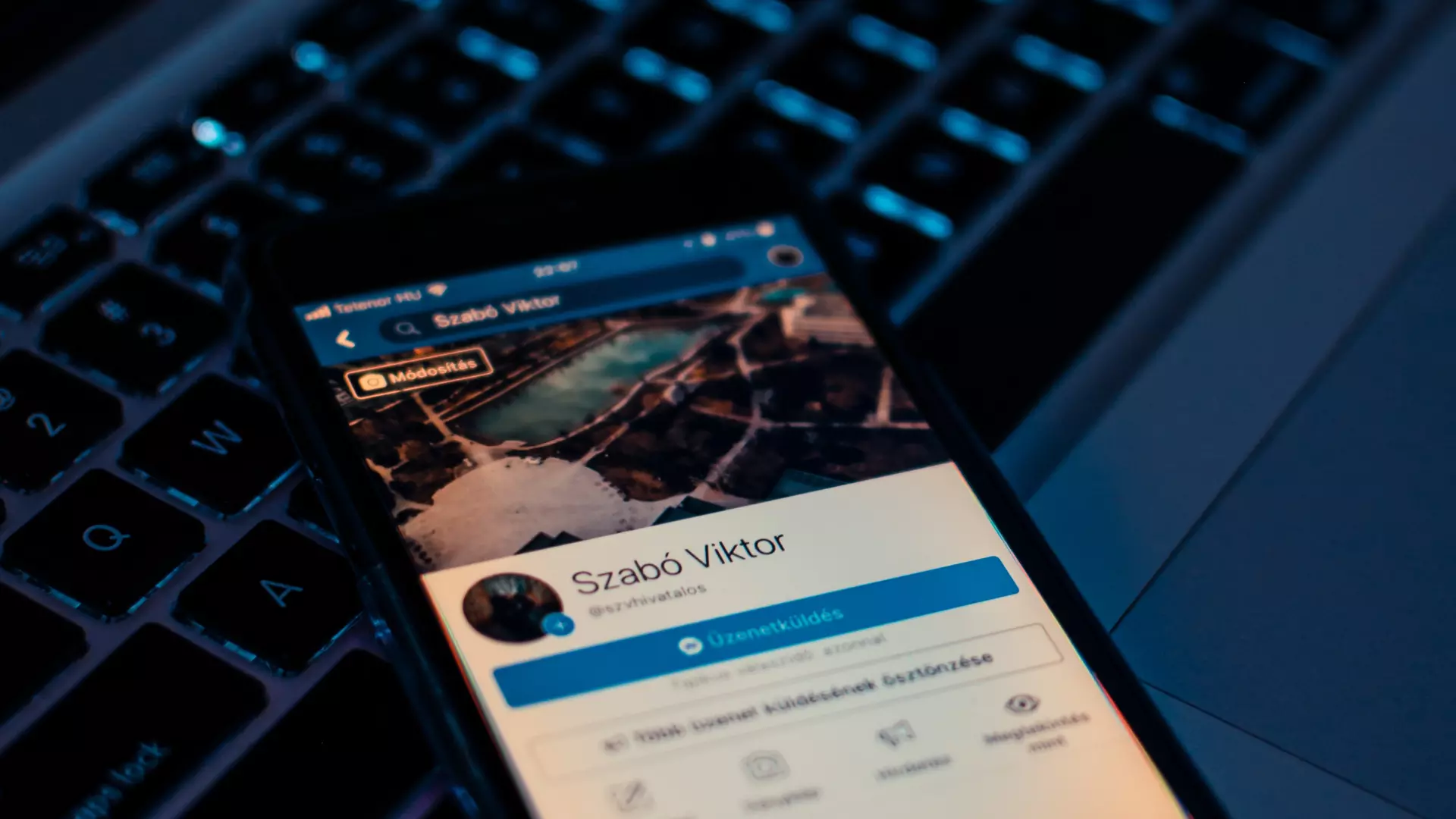

A more secure environment

Artificial intelligence allows FinTech companies to develop anti-fraud systems that detect suspicious transactions. Businesses can also use digital apps to communicate seamlessly with customers, alerting them of security threats.

Better risk assessment

With our services, FinTech firms can manage cash flow with a higher degree of certainty and offer customers more competitive rates.

Chatbots

Chatbots are used to provide customer support and initiate tasks on a human behalf: complete payments, manage transactions, assist in detecting fraud, etc.

Why сompanies choose Altoros

Related cases

Our FinTech software development services

Seeking a solution like this?

Contact us and get a quote within 24 hours